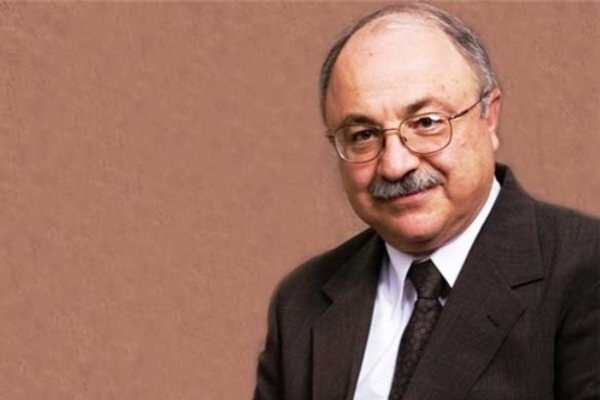

TEHRAN (Bazaar) –Nader Entessar, Professor Emeritus of Political Science from university of South Alabama says that Iran is not a major gas exporter and the country's infrastructure requires significant upgrading for Iran to become a relevant exporter of gas to Europe.

“Iran's domestic gas needs and high gas consumption will not allow Iran to increase its current gas production to become an important gas exporter to Europe,” Entessar told Bazaar.

Following is the full text of the Bazaar interview with Professor Entessar:

Q: The issue of energy is one of the serious concerns of the West this winter. What is your assessment of this issue?

A: It appears that Europe will face serious energy shortages this winter. The U.S. seems to be the only major Western country that will not face the coming energy shortage. The U.S. has some excess capacity to help Europe. However, Washington cannot replace Russia as a major gas supplier to Western Europe.

Q: The New York Times in a report did not consider Iran's entry into the energy market to be a major supplier of European energy and believes that Europe needs gas and Iran does not have the capacity to export gas due to its high gas consumption. What is your assessment?

A: To a large extent, I agree with the report in the New York Times. Iran is not a major gas exporter and the country's infrastructure requires significant upgrading for Iran to become a relevant exporter of gas to Europe. Also, Iran's domestic gas needs and high gas consumption will not allow Iran to increase its current gas production to become an important gas exporter to Europe.

Q: According to the decrease in oil production planned by OPEC for the coming months, Iran's entry into the energy market does not seem to reduce oil prices. What is your assessment?

A: It depends on how fast can Iran enter the global energy market and the volume of oil it can export in a relatively short period of time. Under best conditions, Iran's entry into the energy markets will have a marginal impact on oil prices, and oil prices will not be noticeably affected by Iran's potential contribution to the available volume of oil in the global market.

Q: Considering the reduction of oil planned by OPEC for the coming months, Iran's entry into the energy market also seems to cause a decrease in oil prices. What is your assessment?

A: As I indicated in my answer to the previous question, Iran's reentry into the market may have some impact on the oil prices, but this impact will be marginal and not drastic.

Q: Do you think that the issue of lack of energy will cause Europe to give concessions to Russia in winter?

A: Some European countries have already taken steps in recalibrating their policies toward Russia, and others may do likewise. However, Europe is under pressure from the United States to maintain a united Atlantic front against Russia. So, in some respects, Europe is caught between a rock and a hard place.

Q: Do you think that the revival of JCPOA will be realized before the cold of winter?

A: If the JCPOA is revived, it will most likely be due to geostrategic and political factors and not so much because of the upcoming cold winter in Europe. We should not overestimate Iran's capacity to become a major supplier of energy, especially gas, to Europe this winter.

نظر شما